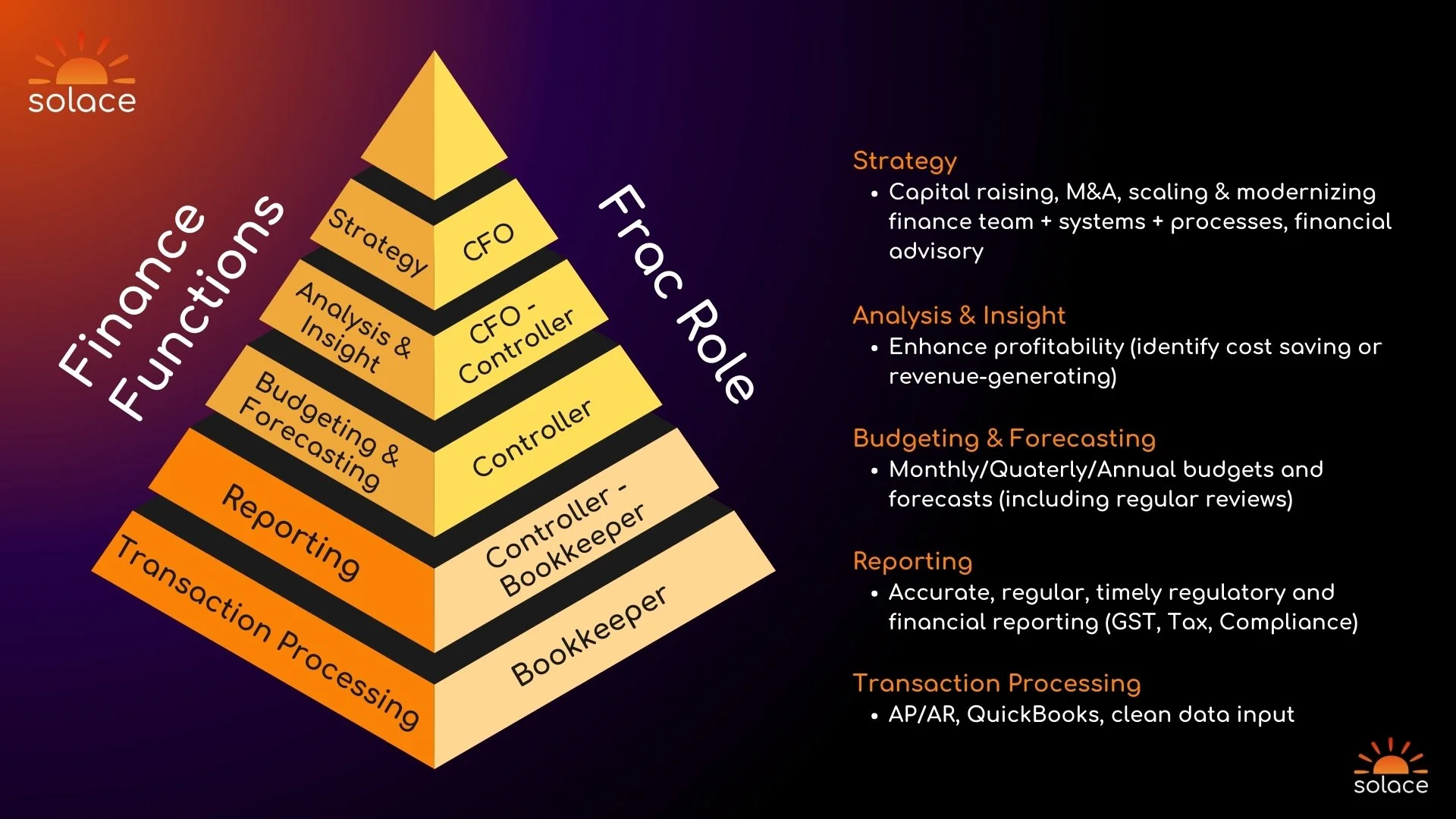

Finance functions and the fractional roles to execute them

🚨 leaders of fast growing start-ups and SMBs: there are absolutely no shortcuts to building a high-performing finance function and it's your responsibility to make it happen.

You've got to build it properly from the ground up if you want the good stuff at the top of the pyramid below.

Want timely, regular, and easily-digestible budgets and forecasts across your business? You first must have accurate financial reporting and mechanisms in place (automated as much as possible).

Want accurate financial reporting? It's table-stakes for any business to first have clean and trustworthy data in a financial system and up-to-date Accounts Payable (AP) / Accounts Receivable (AR) (again, automated as much as possible).

Forget the "Strategy" and "Analysis & Insight" levels of your finance stack if you don't have the bottom three levels sorted first.

A bookkeeper from Day 1 is the most ideal situation, and as you grow you should build on this strong foundation in the order seen below.

As you start to see your revenue or capital climb, Fractional Controllers and CFOs are key to the sustainable growth of your business.

In summary, there are 5 high-level functions of the “finance stack” that should be built from the ground up:

1) Transaction Processing: AP/AR, Quickbooks, clean data input, etc.

2) Reporting: Accurate, regular, and timely regulatory reporting and financial reporting (GST, Tax, Compliance)

3) Budgeting & Forecasting: Monthly/Quarterly/Annual budgets and forecasts (including regular reviews)

4) Analysis & Insight: Enhance profitability (identify cost-savings and revenue-generating opportunities)

5) Strategy: Capital raising, M&A, scaling and modernizing finance teams + systems + processes, financial advisory.

People also ask:

What are fractional finance roles and how do they benefit startups and small businesses? Fractional finance roles, such as fractional CFOs or Controllers, offer part-time financial expertise to companies that may not require or cannot afford a full-time executive. These roles can provide strategic financial guidance, improve financial processes, and help with capital raising efforts at a fraction of the cost of a full-time hire.

Why is accurate financial reporting crucial for the growth of a startup? Accurate financial reporting provides the foundation for making informed decisions, securing investments, and managing resources effectively. It ensures compliance with regulatory requirements and helps identify financial strengths and weaknesses, guiding strategic planning.

How can automation improve the finance function in small businesses and startups? Automation can streamline transaction processing, reduce errors in financial data, and free up time for strategic tasks. It enhances the efficiency of accounts payable and receivable, improves the accuracy of financial reporting, and supports better budgeting and forecasting.

When should a startup consider hiring a fractional CFO or Controller? A startup should consider hiring a fractional CFO or Controller when it begins to experience revenue growth or capital infusion and requires more detailed financial strategy, budgeting, forecasting, and fundraising support that goes beyond basic bookkeeping.

How does a fractional CFO add value compared to a traditional full-time CFO? A fractional CFO provides high-level financial expertise and strategic advice without the full-time salary commitment, making it a cost-effective solution for startups and small businesses. They offer flexibility, scalability, and can adapt their services to the specific needs of the business as it grows.

What should be the priorities when setting up a finance stack for a new business? Priorities should include establishing robust transaction processing systems for accounts payable/receivable, implementing accurate and regular financial reporting mechanisms, setting up budgeting and forecasting processes, and then focusing on analysis, insights, and strategic planning.

How can startups ensure their financial data remains clean and trustworthy? Startups can ensure clean and trustworthy financial data by implementing automated financial systems, maintaining regular audits, employing strict data entry protocols, and hiring experienced financial professionals to oversee financial operations.